Active Fixed Income

Balance income and resilience in today's bond market

Focus on your earnings potential with our time-tested process.

Focus on your earnings potential with our time-tested process.

Help improve investor outcomes with our fixed income resource hub.

Whether you are concerned about continued inflation, interest rate changes, low yields or equity valuations, bonds can play a key role in diversifying risks1 and potentially increasing income to investment portfolios.

Adding bonds to an equity portfolio can serve as a ballast to your equity holdings

when valuations are high or during market volatility.Victory Income Investors has been managing fixed income portfolios for over 50 years and has built a framework designed to help investors determine the best way to invest in fixed income for their goals.

All portfolios should be well-diversified. A well-diversified fixed income portfolio could help investors achieve their capital preservation, income generation and/or additional diversification goals.

It all depends on your fixed income framework. For example, start with a diversifier, like a core or core-plus product, and then align to your goals and risk tolerance.

Consider these potential fixed income portfolio building blocks.

This could be an intermediate core or core plus product depending on risk tolerance. Core holdings typically provide diversification to equities.

Adding a capital preserver, such as a short-term bond fund, can lower overall portfolio duration and fine-tune the portfolio to potentially mitigate interest rate risk.

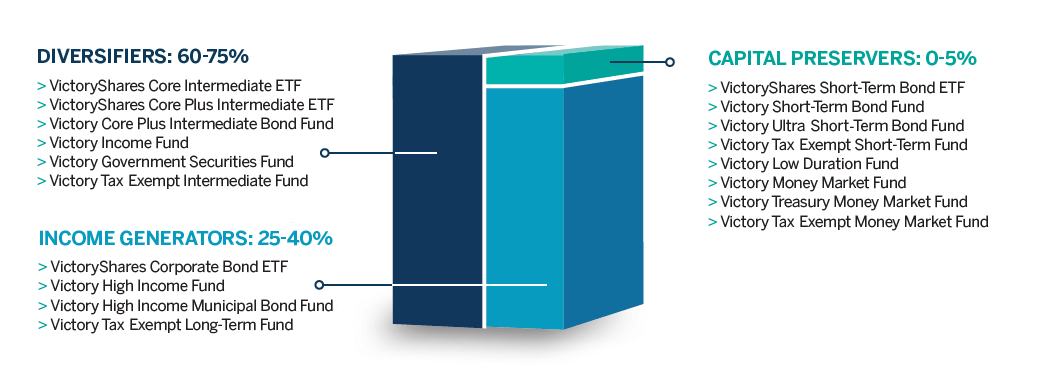

Adding additional fixed income products can then be used to seek specific objectives. The above portfolio prioritizes yield and/or income with an income generator.

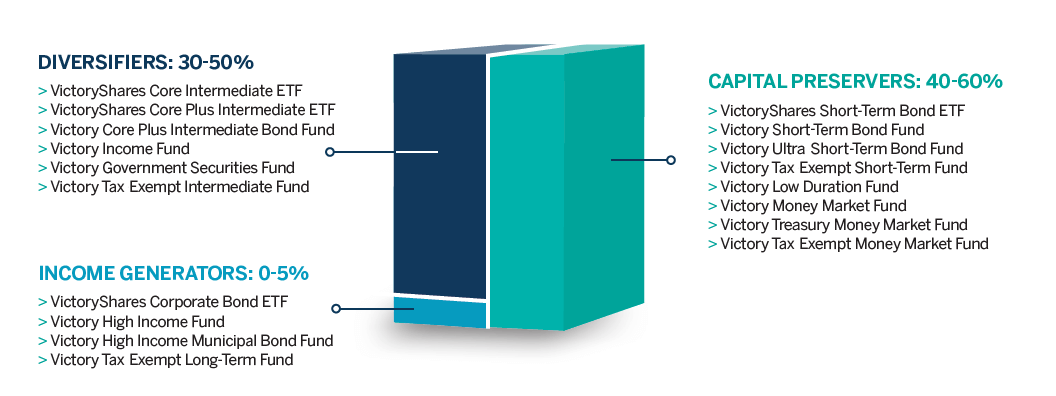

Portfolio construction can also account for expected changes in rates, which will vary based on the direction and magnitude of rate movements. The above portfolio is positioned with the expectation that rates will rise.

Now that you have an idea of a possible framework for building a fixed income portfolio, you can start customizing based on your own goals and priorities.

Select a priority below to learn more.

![]()

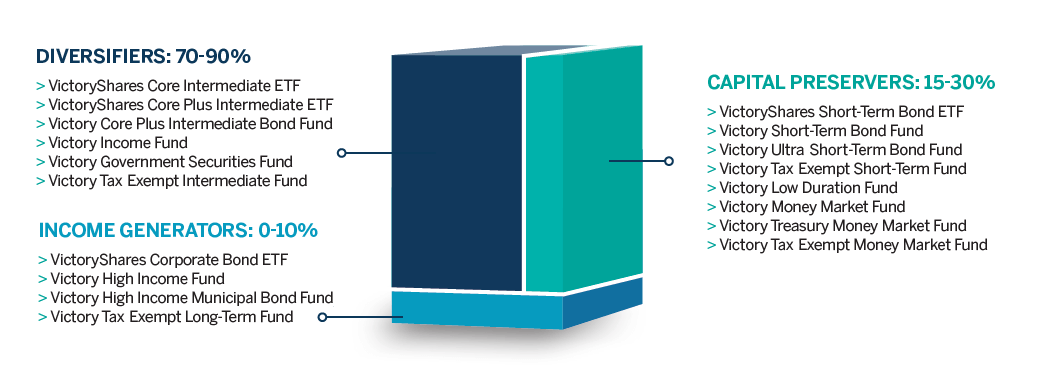

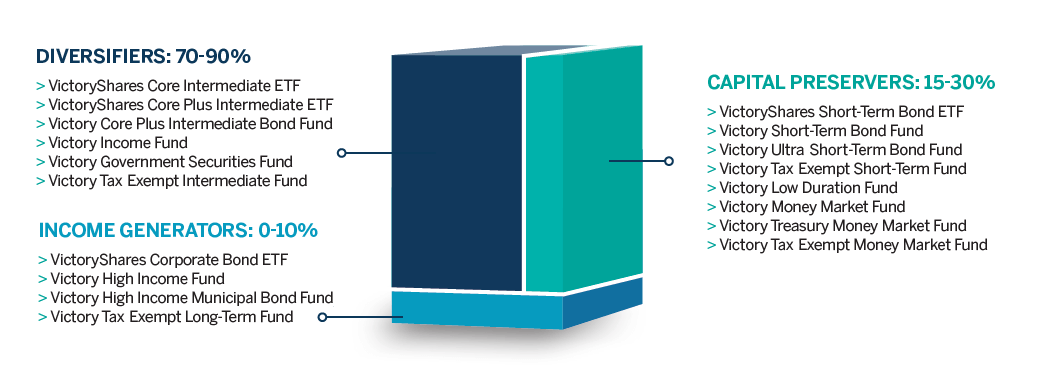

Diversification: Fixed Income portfolios built to prioritize diversification tend to include a varied exposure to credit risk, interest rate risk, and fixed income asset classes. Investors looking for a balanced approach could start here.

![]()

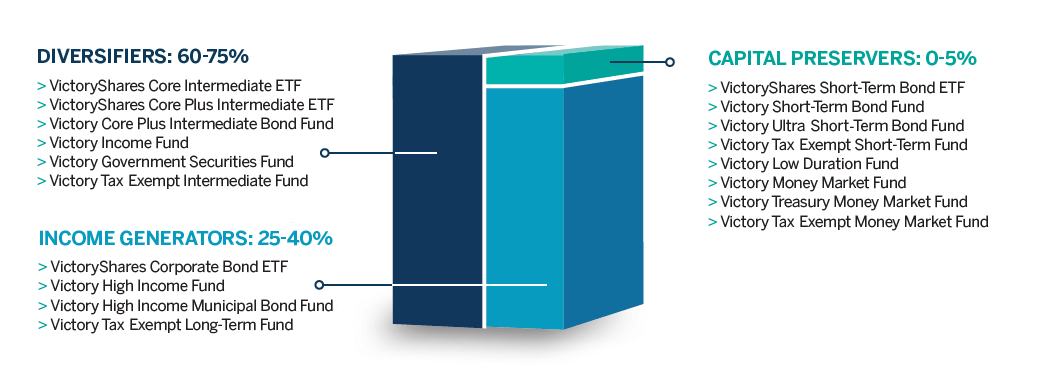

Income: Starting yields are indicative of potential future returns, so if your goal is to maximize the income your fixed income portfolio can offer, it may be beneficial to build your portfolio around yield. Introducing products like high-yield corporate bonds or investment grade corporate bonds to supplement your core holdings, can increase return potential but does invite additional credit and/or interest rate risk. Here’s an example:

![]()

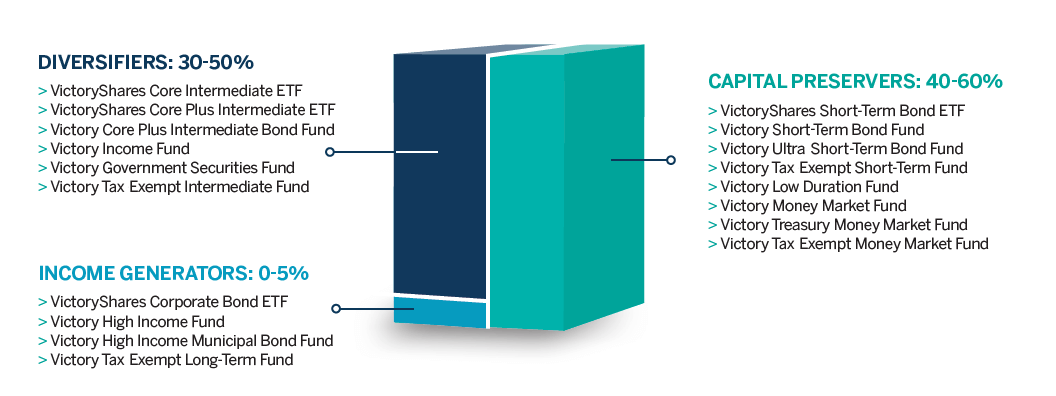

Capital Preservation: Portfolios built with the goal of principal preservation and loss prevention tend to operate on shorter time horizons and have lower interest rate risk. Starting with a diversified core product and customizing with short-term products with lower interest rate risk may help investors preserve hard-earned capital.

![]()

Diversification: Fixed Income portfolios built to prioritize diversification tend to include a varied exposure to credit risk, interest rate risk, and fixed income asset classes. Investors looking for a balanced approach could start here.

![]()

Income: Starting yields are indicative of potential future returns, so if your goal is to maximize the income your fixed income portfolio can offer, it may be beneficial to build your portfolio around yield. Introducing products like high-yield corporate bonds or investment grade corporate bonds to supplement your core holdings, can increase return potential but does invite additional credit and/or interest rate risk. Here’s an example:

![]()

Capital Preservation: Portfolios built with the goal of principal preservation and loss prevention tend to operate on shorter time horizons and have lower interest rate risk. Starting with a diversified core product and customizing with short-term products with lower interest rate risk may help investors preserve hard-earned capital.

For illustrative purposes only; not a recommendation of any specific security or investment strategy.

Overall Morningstar Rating TM

Overall Morningstar Rating TM

Overall Morningstar Rating TM

Overall Morningstar Rating TM

Overall Morningstar Rating TM

Overall Morningstar Rating TM

We construct portfolios using our core competencies in evaluating, taking and managing credit risk with the goal of producing above-market returns over the three- to five-year period.

1eVestment database. 2Track record in the US Core Plus space

Monday-Friday 9 am-6 pm (ET)

Invest directly from your account or call us at 1-800-235-8396 for a personalized recommendation at no additional cost.

1Diversification does not promise any level of performance or guarantee against loss of principal.

2Source: Bloomberg. Based on monthly interest of cash, as represented by the Average 1YR CD Rate – YoY CPI, and bond yields, as represented by Yield to Worst of U.S. Aggregate Bond Index - CPI versus the rate of inflation, as represented by the CPI - YoY, Consumer Price Index, from February 2004 through April 2025.

20260102-5092355