Target risk funds are mutual funds designed to maintain a relatively constant level of investment risk over time. This is accomplished by keeping their asset allocation within a set – or target – range. Target risk funds can take the guesswork out of portfolio management. There may be a target risk fund appropriate for many investors across the risk-return spectrum.

How to Target Risk

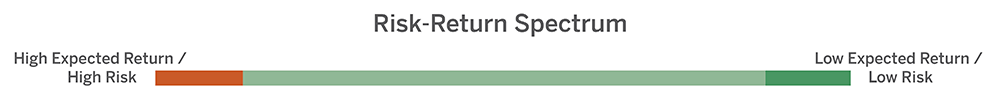

Risk and return are positively correlated.[i] Generally, if one of them is high (or low), so is the other. This relationship between risk and return can be illustrated on a continuum, or risk-return spectrum.

At one end of the spectrum are portfolios that may deliver high expected return, but also have a higher risk of losing value. At the other end are portfolios that may deliver lower expected return, but typically have lower risk of losing value.

Between the two extremes are portfolios that deliver varying degrees of risk and return. Which portfolio along this continuum is appropriate depends on the investor’s unique risk tolerances, time horizon, and goals.

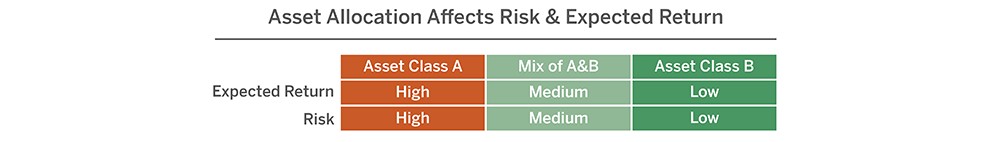

Portfolios that deliver high expected returns may subject some investors to uncomfortable levels of risk. Portfolios with lower risk might not meet the return expectations of other investors. The table below provides a simple illustration using two different asset classes.

The main difference in all of this is asset allocation, the mix of investment types in the portfolio. Asset allocation is the key determinant of risk and return.[ii] Target risk funds take advantage of this.

Benefits of Target Risk Funds

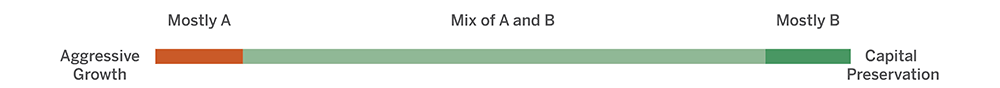

A prominent feature of target risk funds is that their asset mixes are tailored to match the risk appetites of various investors.

So, one target risk fund might invest in assets with relatively high risk (like Asset Class A from the table above). Another fund might seek to mitigate risk and invest primarily in Asset Class B.

The fund using Asset Class A might be suitable for investors who are comfortable with higher fluctuations in the value of their portfolio and are seeking higher investment returns. The one comprised of Asset Class B might be more appropriate for investors with a lower risk tolerance and return expectation.

This is how target risk funds serve investors.

They are structured to accommodate investors whether their risk tolerance is high or low. This is why target risk funds may be appropriate for many different types of investors.

Sometimes referred to as “all-in-one” funds, target risk funds could represent the cornerstone of an investor’s portfolio. This is because they provide a level of diversification intended to match the risk tolerance of investors across the risk-return spectrum.

investor designed to emulate a narrow range of risk and return parameters.

Keeping an eye on the Target

As asset values change over time, a target risk fund will rebalance investments to stay within predetermined allocations.

Rebalancing may help a target risk fund maintain its specific risk-return characteristics through a complete market cycle. This makes target risk funds a simple way to maintain a constant level of risk for investors across the risk-return spectrum.

Keeping an eye on the target helps avoid negative surprises whether a fund’s investment objective is capital preservation, aggressive growth, or somewhere in between.

As market values fluctuate, target risk funds adjust their portfolio holdings to stay inside their predetermined asset allocation ranges.

This can relieve individual investors from making (or failing to make) critical portfolio management decisions on their own.

Other Characteristics of Target Risk Funds

The structural aspects of a target risk fund also include daily oversight by professional investment managers. Active portfolio managers may provide additional value by making tactical decisions when necessary.

Because target risk funds seek to achieve specific investment objectives across the risk-return spectrum, they may be appropriate for investors at various stages of the financial journey, whether they are just starting out or have decades of investing experience.

Target risk funds give individual investors access to institutional investment managers, who may oversee billions of dollars invested across multiple asset classes. Some target risk funds have low investment minimums, sometimes as little as $50. Many offer automatic investment opportunities. Even when they are modest, over time regular investments can contribute to meaningful wealth creation. Click here to learn more about the benefits of an automated investment plan.

As each target risk fund will have its own unique investment objective, management style, risks, and investment minimums, it is important to become familiar with these characteristics of any funds you may be considering. These and other important details can usually be found in the fund prospectus.

[i] Source: FINRA.

[ii] Gary P. Brinson, L. Randolph Hood, Gilbert L. Beebower, Determinants of Portfolio Performance, Financial Analysts Journal, January 1995, Volume 51, Issue 1.