Fixed income: No need for alarm

JIM JACKSON, CFA 16-Mar-2022

Hey, bond investors: let’s not hit the panic button just yet!

The worst of the pandemic seems to be behind us and by most accounts, the U.S. remains on pace for steady economic growth in 2022 and beyond. That’s great news. Yet some fixed income investors are worrying about the Federal Reserve’s pivot to a less accommodative policy and its stated intentions to ratchet up short-term interest rates to combat inflation.

Although a rising rate environment can be tricky for some fixed income asset classes, it needn’t be a cause for alarm. Market “wisdom” is that rising rates necessarily lead to poor fixed income returns. But a look back at prior periods in which the Fed steadily hiked interest rates should comfort investors and reinforce the importance of fixed income’s role in a well-diversified portfolio.

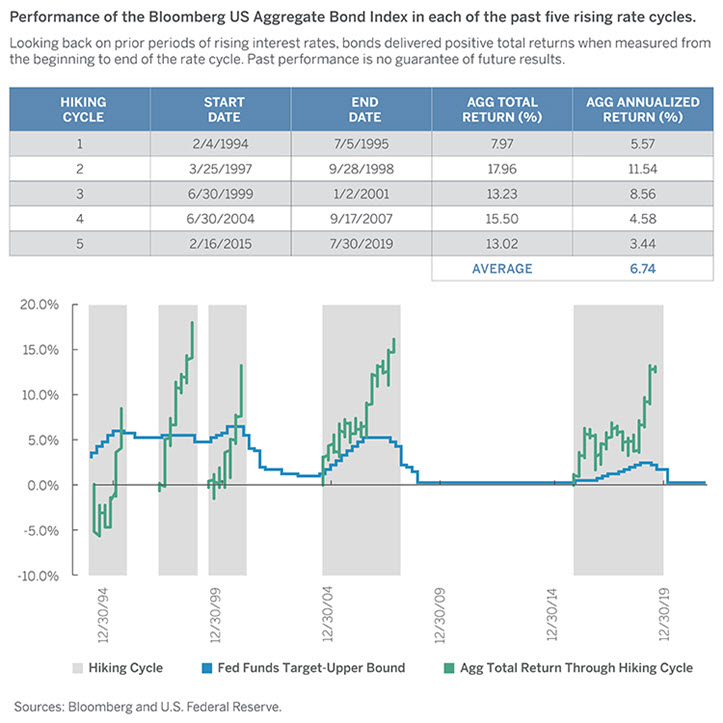

Let’s turn to the tape. The chart below shows the performance of the Bloomberg US Aggregate Bond Index—a popular fixed income index and a proxy for a diversified bond portfolio—during the last five rising rate cycles. These periods appear as the shaded areas in the graph below.

In each of the last five rising-rate cycles, the Bloomberg US Aggregate Bond Index delivered positive returns. Yes, there were instances of elevated volatility, typically during the initial weeks of the cycle as financial markets gauged how far and for how long the Fed might hike. However, total returns by the end of the last five rising rate cycles turned positive, and often quickly.

Stay the Course

Although splashy headlines may question the role of bonds in portfolios, we continue to see fixed income as an important source of cash flow and a lower-volatility counterbalance to equities or other riskier components of a diversified investment portfolio.

Further, as getting interest rate predictions correct is notoriously difficult, we caution against trying to time allocation decisions to fixed income. Rather, we believe that the better way is to think longer term and stick with the consistent and time-tested approach of maintaining an allocation in your portfolio to income-generating bonds.

We also caution against trying to trade in and out of different segments of the yield curve to shorten or lengthen duration. Duration is a measure of a bond’s sensitivity to changes in interest rates, such that the higher the duration, the greater the sensitivity and the greater the potential movement in bond price for a given change in interest rates. Early in past rate-hiking cycles, when markets were pricing in rising rates, bonds may have suffered price declines. However, these declines were more than offset in subsequent years by the higher yields after the rate hikes. Therefore, we believe that attempts to fine tune duration based on expectations of rate increases alone can lead to over-reactions and unnecessary portfolio churn.

Of course, an advisor can and should help individual bond investors match interest rate risk tolerance to duration exposure. But we believe duration exposure should be relatively constant over time rather than subjected to constant adjustment on imperfect rate expectation forecasts.

Fixed income is no different than so many investments: less emotion and more analysis is a formula for better results. Start with why you invested in fixed income in the first place—probably for income and stability. Add to that how bonds have performed during prior rate hiking cycles. As shown above, higher income from an increase in rates has tended to offset initial bond price declines. And because we believe it’s income that drives bond returns, stay the course and resist the temptation to impulsively adjust allocations. There’s no cause for alarm.