Sequence of returns risk is the uncertainty that a portfolio might lose value just as the investor needs to rely on it. It is a real-world consequence of stock market volatility. It may be especially concerning for those in or nearing retirement. Investors can, however, plan for sequence of returns risk. There may also be ways to reduce its severity.

Stages of Retirement Planning

There are two stages of retirement planning: accumulation and distribution. They happen sequentially, one after the other.

Investors accumulate retirement assets using vehicles like 401(k)s, the government-sponsored Thrift Savings Plan (TSP), or Individual Retirement Arrangements (IRAs). Some investors contribute to these types of accounts throughout their working lives.

Then they retire.

Many people rely on their 401(k), TSP, or IRA to finance retirement living expenses. This is the distribution stage of retirement planning.

Sequence of Returns During the Accumulation Stage

Two characteristics of common stocks may make them suitable to finance retirement goals, which for many may be decades away.

1) Stocks have historically provided higher rates of return than other investments.i

2) This higher return occurred (on average) over long time horizons.

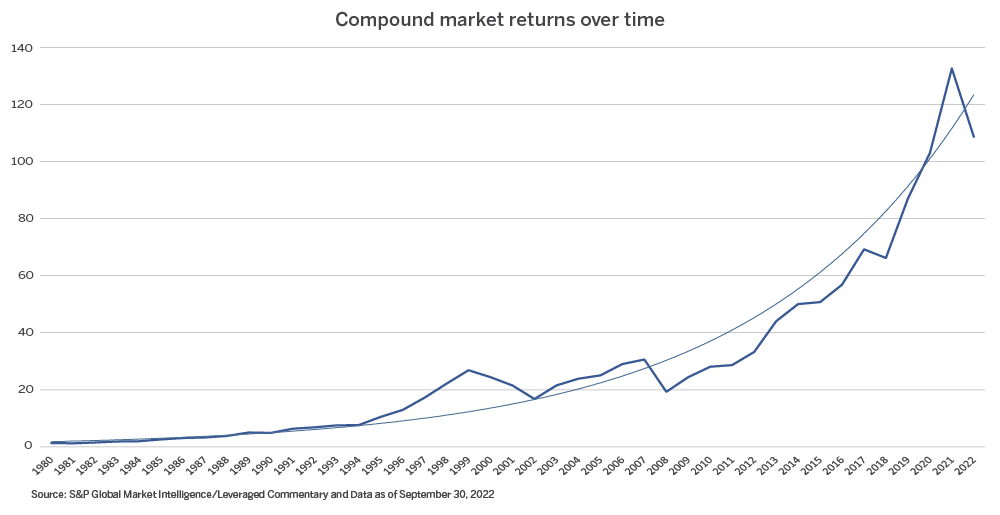

The chart above illustrates the return of the S&P 500 from January 1, 1990 to December 31, 2022. During this period, the Compound Annual Growth Rate (CAGR) of the S&P 500 was 10.79 percent, not including dividends.

Now, it’s important to note that this example is offered for illustration purposes only. Investors can’t actually own an index, and of course, past performance is no guarantee of future results. The CAGR noted here does not include any fees or commissions, which would have decreased an investor’s net return.

What the chart demonstrates is that over the long-term average returns have helped to soften the blow of short-term volatility.

Timing and volatility are at the heart of sequence of returns risk.

Investors in the accumulation stage typically benefit from a long-term perspective. That’s why attempts to time periodic market cycles (peaks and troughs) are generally considered futile. But timing shifts in asset allocation may be fruitful for some investors – especially those at or near retirement.

Sequence of Returns Risk and Retirement Planning

Common stock investors at or near the distribution stage may not benefit from a long-term perspective. For them, sequence of returns risk may be a more immediate concern. A big loss right when someone stops working could put future consumption goals at risk.

Contemplating sequence of returns risk early in a retirement plan might make sense. The shift from accumulation to distribution may happen precisely at retirement. But an investor can plan for this precise moment. For some that might be the whole point: to prepare for the day they flip the switch.

This might mean gradually transitioning a portfolio from a growth mode to an income mode. It may take many steps, each one adjusting asset allocation.

Asset Allocation and the Risk/Return Tradeoff

Different asset classes (stocks, bonds, etc.) have exhibited relatively predictable ranges of risk and return over time. Asset mix is important in estimating a portfolio’s future value and is the primary driver of portfolio risk and return.ii

Altering a portfolio’s asset allocation will change its risk/return profile. For example, a shift from all stocks to a mix of stocks and bonds will likely lower a portfolio’s expected return. As a portfolio’s allocation to bonds increases (relative to stocks), its expected return is predicted to decline.

Importantly, this same shift in asset allocation would also likely lead to a decline in the portfolio’s level of risk. A lower allocation to stocks reduces the portfolio’s exposure to stock market volatility. This may decrease exposure to sequence of returns risk.

Asset Allocation and Future Consumption Goals

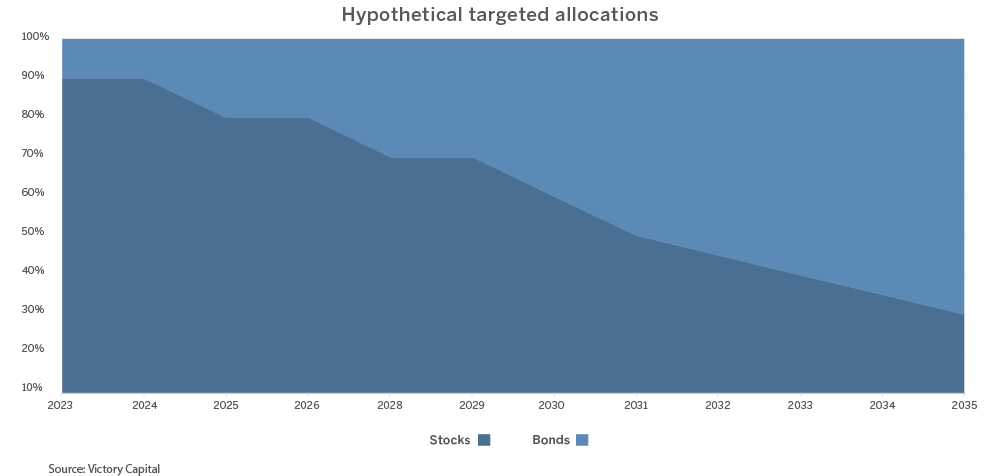

The graph below illustrates a hypothetical shift in asset allocation over time. A shift like this might be effected along a predetermined schedule as one nears retirement.

It’s important to note that this is for illustrative purposes only. It’s not a recommendation. Investors should seek advice from qualified financial experts regarding their particular circumstances before adopting any strategy.

The appropriateness of this particular strategy would be determined by the investor’s future consumption goals and the portfolio’s estimated future value, which would considers its current balance, projected contributions and the portfolio’s expected return.

Since changes in asset allocation affect expected return, the desire to reduce sequence of returns risk is probably best considered in the context of a holistic financial plan.

Consult your Retirement Plan Advisor to learn more about the key milestones in your retirement planning journey.

1 Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan M Taylor, (2019), The Rate of Return on Everything, 1870–2015, The Quarterly Journal of Economics, Oxford University Press, vol. 134(3), pages 1225-1298.

2 Roger G. Ibbotson & Paul D. Kaplan, (2020) Does Asset Allocation Policy Explain 40, 90, or 100 Percent of Performance?, Financial Analysts Journal, 56:1, Pgs. 26-33, January 2, 2019.