Successful retirement planning may be aided by an understanding of the rules governing qualified accounts, like 401(k)s and IRAs. There are rules for both the accumulation phase and the distribution phase – each of which may offer planning opportunities. Here are some key milestones to consider in the retirement planning process.

Phases of Retirement Planning

The two phases of retirement planning include an accumulation phase and a distribution phase. There are rules governing each phase. These rules define specific milestones that may be considered in an investor’s retirement plan. They include:

- What happens at age 50

- What to consider at age 55

- What ends at age 59½

- The Social Security decision between ages 62 and 70

- What begins at age 73

What happens at age 50

All qualified plans have annual contribution limits. Many provide an increased – or “catch-up” – contribution provision for investors who reach age 50.[1]

The catch-up contribution is an additional amount that can be added to a retirement plan over and above the typical annual limit. These excess contributions are voluntary and may be used by investors to make up for previously missed contributions.

Catch-up contributions may also be used to accumulate additional assets in tax-deferred accounts or to reduce taxable income by the amount of the contribution.

What to consider at age 55

The Internal Revenue Service (IRS) recognizes that some people leave (or lose) their jobs before they actually intend to retire. Sometimes, this might compel them to take early distributions from their 401(k)s.

Participants in company sponsored retirement plans who leave their employers (for any reason) the year they reach age 55 or later can withdrawal funds from those plans without triggering early withdrawal penalties. This is referred to as the IRS rule of 55.[2]

Rule 55 distributions are not subject to a penalty. But they are considered taxable income, subject to mandatory withholding.[3] They apply only to a person’s last employer.

Distributions from other previous employers’ plans taken at age 55 would generally be subject to early withdrawal penalties.

The rule of 55 does not preclude a person from starting a new job.

What ends at age 59½

Qualified accounts like 401(k) plans and IRAs are designed to be long-term savings vehicles. The rules governing them are intended to discourage withdrawals before “retirement.”

Early withdrawals from retirement accounts are subject to a 10% penalty. Those penalties don’t apply after a person reaches age 59½, but taxes still do.

Regardless of age, all distributions from an IRA or a 401(k) not transferred directly into another qualified plan are considered taxable income. Such withdrawals are subject to mandatory withholding.

The Social Security decision between ages 62 and 70

Social Security is available to people starting at age 62, but the benefit will not be the full amount. Benefits received at age 62 are paid at a reduced rate. Full Social Security benefits are paid when someone attains “full retirement age” (FRA).

People born before 1954 reached FRA at age 65. Those born between 1955 and 1959 attain FRA in a month between their 66th and 67th birthdays. For people born in 1960 or later, FRA is 67.

Delaying Social Security beyond FRA increases a person’s benefits. Those increases end at age 70.

What begins at age 73

Assets held in retirement accounts must start to be withdrawn beginning the year a person reaches age 73. These withdrawals are called Required Minimum Distributions (RMD)s. Prior to 2023, the beginning age for RMDs was 72.

Reaching age 73 is the trigger for RMDs. People are permitted to delay the first distribution. They can wait until the year after their 73rd birthday.

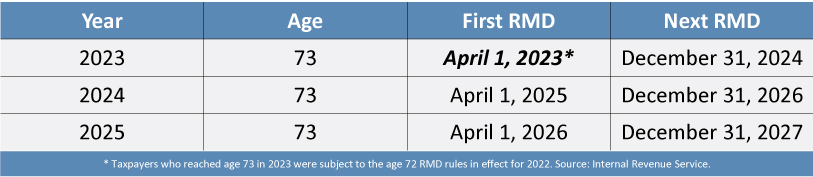

A person’s first RMD must be taken by April 1st the year after attaining the age of 73. After that, RMDs must be made every year by December 31st.

Here are examples of how this works.

The table above shows that people reaching age 73 in any month in 2023 must have taken their first RMD by April 1, 2023.[4] They were subject to prior RMD rules.

By contrast, people who turn 73 in any month in 2024 must take their first RMD by April 1, 2025.

Under the new rules, the first RMD can be delayed. After that, all RMDs must be made by December 31st in each subsequent year.

The penalty for missing an RMD is 25 percent. This also applies to any shortfalls. If the entire RMD amount is not withdrawn by the due date, the penalty is imposed on the difference between the required minimum and the amount actually withdrawn.

While errors or omissions corrected within two years may reduce the penalty to 10 percent, missing an RMD can be an expensive mistake.

Consult your Retirement Plan Advisor to learn more about the key milestones in your retirement planning journey.

[1] Catch-up contributions apply to IRAs, 401(k)s, 403(b)s, 457(b)s, SARSEPs, SIMPLE-401(k)s and SIMPLE-IRAs. Source: Internal Revenue Service.

[2] The rule of 55 applies only to workplace plans. It excludes all forms of IRAs. A plan administrator may impose specific rules for how distributions may be taken. Source: Internal Revenue Service.

[3] Distributions paid directly to a plan participant are subject to mandatory withholding of 20 percent. Source: Internal Revenue Service.

[4] Taxpayers who reached age 73 in 2023 were subject to the age 72 RMD rules in effect for 2022. Source: Internal Revenue Service.