Am I being charged fees for my plan investments?

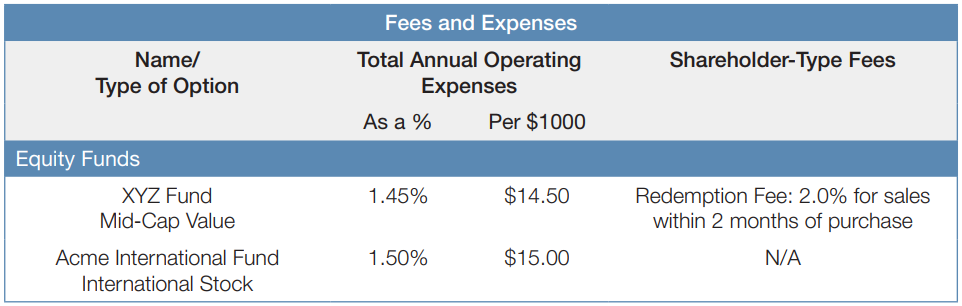

There are costs associated with operating a mutual fund. This is true whether the investment is purchased through a retirement plan or through another type of investment account. The costs of operating a fund are referred to as the “total annual operating expenses” or “expense ratio.” These costs reduce the average annual total return of the fund. Total annual operating expenses will be listed on the comparative chart for each plan investment. They will be presented as both a percentage of assets and as a dollar amount (based on each $1,000 invested). For example, if a fund lists total annual operating expenses as 1.45%, it means that 1.45 percent of the fund’s assets, or $14.50 per each $1,000 in the fund, will used to cover the expenses of operating the fund.

In addition to the costs of operating a fund, there may also be service charges or fees referred to as “shareholder-type fees” that are charged when you purchase or sell shares. These fees are typically charged directly to your account. For example, a sales charge may be assessed when you initially purchase shares and deducted from the amount you invest. Sales charges may also be assessed when you sell the shares, referred to as a deferred sales charge. Sales charges help cover the cost of commissions paid to the advisor who sold you the fund. Another type of shareholder fee is a redemption fee, which is deducted when shares are sold in a short period of time. A redemption fee is paid to the fund to defray the cost of redeeming the shares and is also designed to discourage frequent trading, since mutual funds are generally considered long-term investments. For example, a fund that charges a 2% redemption fee for sales within two months of purchase would list that in the shareholder-type fee column of the comparative chart. In many cases, 401(k) investments will not be subject to shareholder-type fees, and the comparative chart will either be left blank or contain the phrase “not applicable” or “N/A” in the shareholder-type fee column.