Fixed income: Still your portfolio ballast

ZACH WINTERS, CFA JIM JACKSON, CFA 10-Feb-2021

Navigating 2020 was anything but easy for investors, especially early in the year. But after coming to grips with a global pandemic—and with an assist from fiscal and monetary policy-makers around the world—the global economy and financial markets regained their footing.

So, what’s the problem? Many pundits have cautioned that the extraordinary measures taken during 2020—including two massive doses of fiscal stimulus passed by Congress, as well as the Fed slashing short-term interest rates interest rates by 150 basis points to 0%, will have longer-term ramifications. Perhaps so. But a few strategists are going one step further and suggesting that bonds will no longer play their traditional counterbalancing role in a diversified investment portfolio.

Not so fast. We believe that view is a little alarmist—even emotional. And emotional investing is never a good idea.

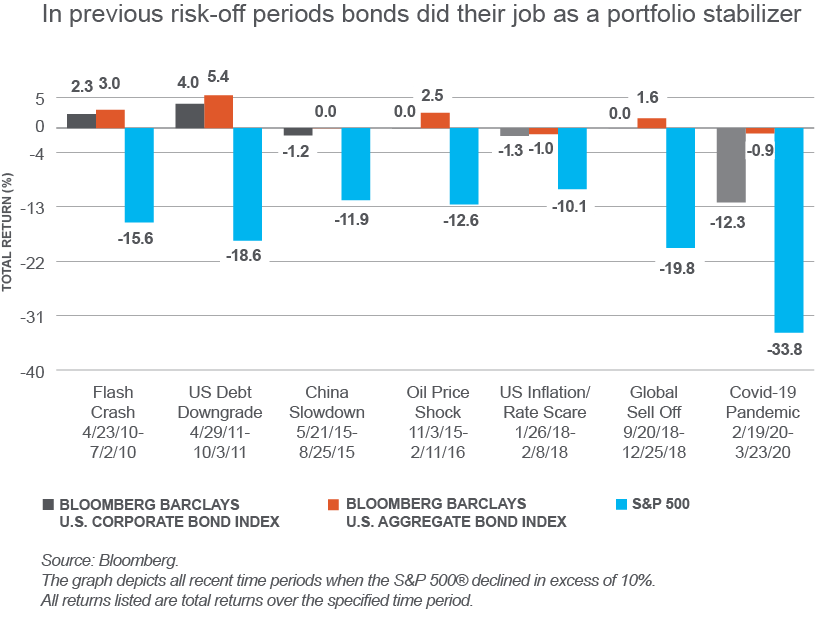

Before acting rashly, let’s look at the data and consider that bonds have a long history as a consistent ballast in a diversified portfolio during risk-off periods. This a long-term, multi-decades track record. More importantly, even in extreme periods of market dislocations, such as the Global Financial Crisis in 2008/09 and the more recent COVID-19 market turmoil, the price decline of bonds (including credit-focused strategies, not just Treasury bonds) has been magnitudes lower than the S&P 500 Index, which is a widely accepted proxy for stocks.

The accompanying graph illustrates how bonds are more than capable of offsetting portfolio volatility from equities exposure, even in times of stress. Over the past decade, every time the S&P 500 has declined by more than 10%, bonds performed their role as a ballast to offset equity market drawdowns. Admittedly, this might be diminished slightly given current, very low yields, but there’s no question that high-quality investment-grade bonds have historically exhibited ample diversification benefits.

So, assuming we’re not ready to panic yet and throw bonds overboard, the question shifts to one of tactics. We believe that within the expansive fixed income universe, credit sectors (i.e. corporate bonds, municipals and structured products), have an income advantage over lower-yielding Treasuries. This might be appreciated by investors given where rates are today. Indeed, the potential to capture that yield differential between credits and Treasuries (the credit spread) appears significant, evidenced by the difference between the yield on the Bloomberg Barclays US Corporate Index and the yield on the Bloomberg Barclays US Treasury Index. Thus, we believe that credit sectors still provide reliable income potential for investors, and that the incremental yield potential they offer might help cushion any impact of rising rates.

Moreover, even for investors who are truly concerned about rising rates, it’s important to remember that credit spreads historically have been negatively correlated to interest rates. In other words, when Treasury rates increase, spreads usually tighten, which in turn acts to offset price declines from rising rates. In effect, this is part of the appeal of credit doing its job—acting as a ballast for the portfolio.

So, while we can all acknowledge the unusual measures taken to combat the pandemic during 2020, as well as the uncertainties regarding future interest rates, we continue to believe that an allocation to fixed income—and more specifically a tilt toward actively managed credit strategies—is appropriate as part of a diversified investment portfolio.